housing allowance for pastors fannie mae

Pastoral Housing Allowance for 2021. I dont think the IRS would consider 100 an hour reasonable compensation for your service.

Follow Conservatives Against Trump S Carlosvignote Latest Tweets Twitter

These allow ministers of the gospel to exempt all of their housing expenses from federal income taxes.

. Therefore it is important to request your housing allowance and have it designated before January 1 so that it is in place for all of 2020. Classroom Commander Student Adobe Lightroom For Student Lightroom For Students. Housing allowances can include all big-ticket housing expenses such as mortgage payments rent utilities home insurance home improvements and so much more.

The amount that a minister can utilize for their housing allowance varies. As long as we can document the receipt of the housing income through a signed letter from the churchemployer stating the actual breakdown of the pay and by providing copies of the checks received we should be able to. They are treated as employees for income tax purposes and self-employed for social security tax purposes.

It is a form of income to fully pay or at least offset a part of the expense to own or rent a home. What is a Clergy Housing Allowance. These can cost hundreds of dollars and are difficult to obtain.

How To Determine What Qualifies For The Clergy Housing Allowance. September 8 2020. When a portion of compensation is received as housing allowance federal and state taxes are.

All states except Pennsylvania allow a ministers housing expenses to be tax-free compensation. Housing allowance for pastors fannie mae. Wednesday March 30 2022Edit.

There are only three ways to find out for sure if something qualifies. And if the church provides a home for you that is considered a. Your housing allowance is also limited to an amount that represents reasonable pay for your ministerial services.

If the church pays for your house based on its fair market value its a housing allowance. If you receive money from the church for house rent it is called a rental allowance. Only expenses incurred after the allowance is officially designated can qualify for tax exemption.

The list of best recommendations for Housing Allowance Fannie Mae Guidelines searching is aggregated in this page for your reference before renting an apartment. A housing allowance is often a common and critical portion of pastoral income. That can be worth quite a bit of money so who.

According to tax law if you are planning to claim a housing allowance deduction actually an exclusion for the upcoming calendar year your Session is required to designate the specific amount to be paid to you as. If you receive as part of your salary for services as a minister an amount officially designated in advance of payment as a housing allowance and the amount. This comes in two forms.

The Ministers Housing Allowancesometimes called a parsonage allowance or rental allowanceis excludable from a pastors gross income for federal and state income tax purposes but not for self-employment tax purposes. It may not encompass expenses incurred as the result of commercial properties or vacation homes Any items for inclusion must be personal in nature for the. The housing allowance for pastors is not and can never be a retroactive benefit.

Even though it is not reported on the tax returns a pastors housing allowance can be used in qualifying for a mortgage loan to purchase or refinance a home. The housing allowance provides an excellent benefit for pastors and their families to. That means that if you only work ten hours a week at the church then you cannot claim a 50000 housing allowance.

The largest benefit of the income is that it. A housing allowance offers ministers the ability to deduct a portion of their gross income that they spend on housing costs from their federal income taxes. You have several questions going here but basically the answers are that church employed Senior Pastors and Associate Pastors are treated the same if they meet the 5 question criteria set up by IRS.

Contributions you make to a church retirement plan usually a 403 b 9 as a pastor are a part of your pastoral income. As I mentioned in my article on the Deason Rule individuals such as pastors receive compensation for basic living expenses. 10 Housing Allowance For Pastors Tips 1.

It is time again to make sure you update your housing allowance resolution. Get the IRS to issue a private letter ruling regarding your specific situation. Ministers housing expenses are not subject to federal income tax or state tax.

The housing allowances for each are NOT. So when you take them out in retirement they are still considered eligible pastoral income. One of the greatest financial benefits available to pastors is the housing allowance exemption.

According to the IRS the housing allowance of a retired minister counts because it is paid as compensation for past services. For example if your housing allowance is 12000 per year and you only spend 11000 on housing expenses youll need to include the 1000 in your gross income. The housing allowance is equal to 80 of the difference between the housing costs and the basic deductible or 08 x 720 - 57834 08 x 14166 EUR 11333 per month.

The IRS allows a ministers housing expenses to be tax-free compensation to the minister when the church properly designates a housing allowance. The ministers cash housing allowance and parsonage allowance. A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self-employment tax purposes.

A housing allowance may include expenses related to renting purchasing which may consist of down payments or mortgage payments andor maintaining a clergy members current home.

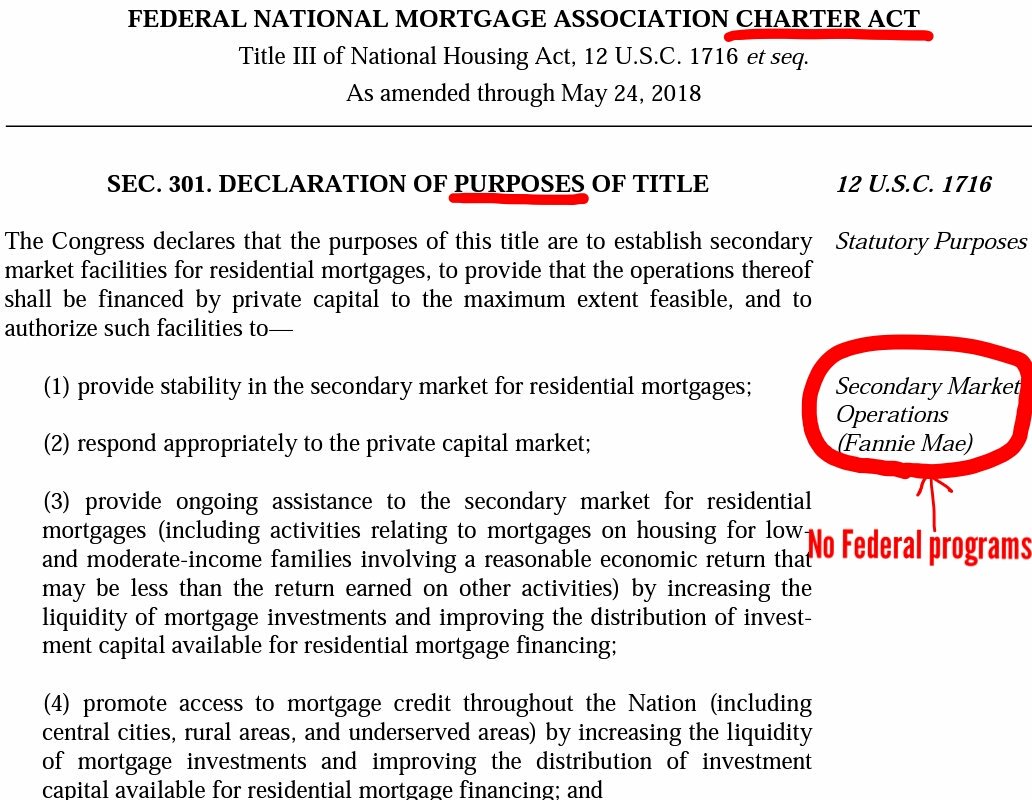

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Fannie Mae

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Fannie Mae

Pastoral Housing Allowance Using Nontaxable Income To Buy A Home

Pastoral Housing Allowance Using Nontaxable Income To Buy A Home

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Fannie Mae

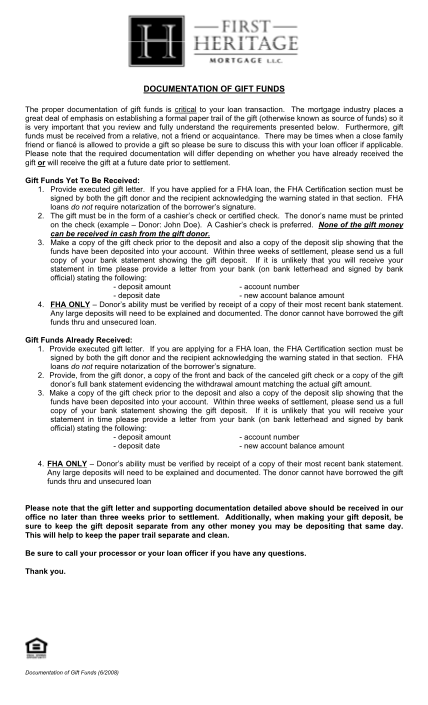

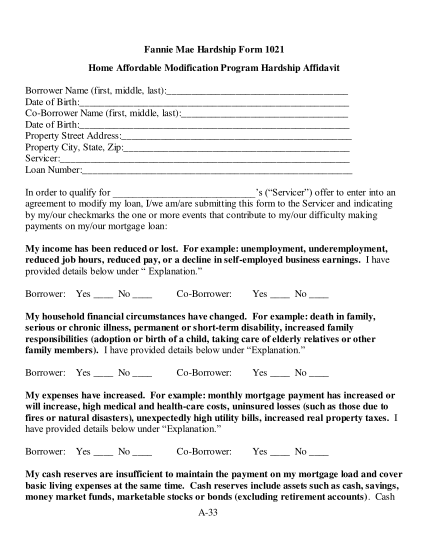

94 Mortgage Template Word Page 2 Free To Edit Download Print Cocodoc

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages We Ve Dropped Our Minimum Fico Score To 620 For Kentucky Mortgage Loan Approvals

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Mortgage Lenders Mortgage Kentucky

How Do Pastors Clergy Or Ministers Qualify For A Usda Loan Usda Loan Pro

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Effective On 9 18 21 Fannie Mae Announced That Their Automated Underwriting System Will Now Take An Average Of The

Clergy Housing Allowance Mortgage Solutions To Buy A Home

Follow Conservatives Against Trump S Carlosvignote Latest Tweets Twitter

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Effective On 9 18 21 Fannie Mae Announced That Their Automated Underwriting System Will Now Take An Average Of The

94 Mortgage Template Word Page 2 Free To Edit Download Print Cocodoc

How Do Pastors Clergy Or Ministers Qualify For A Usda Loan Usda Loan Pro

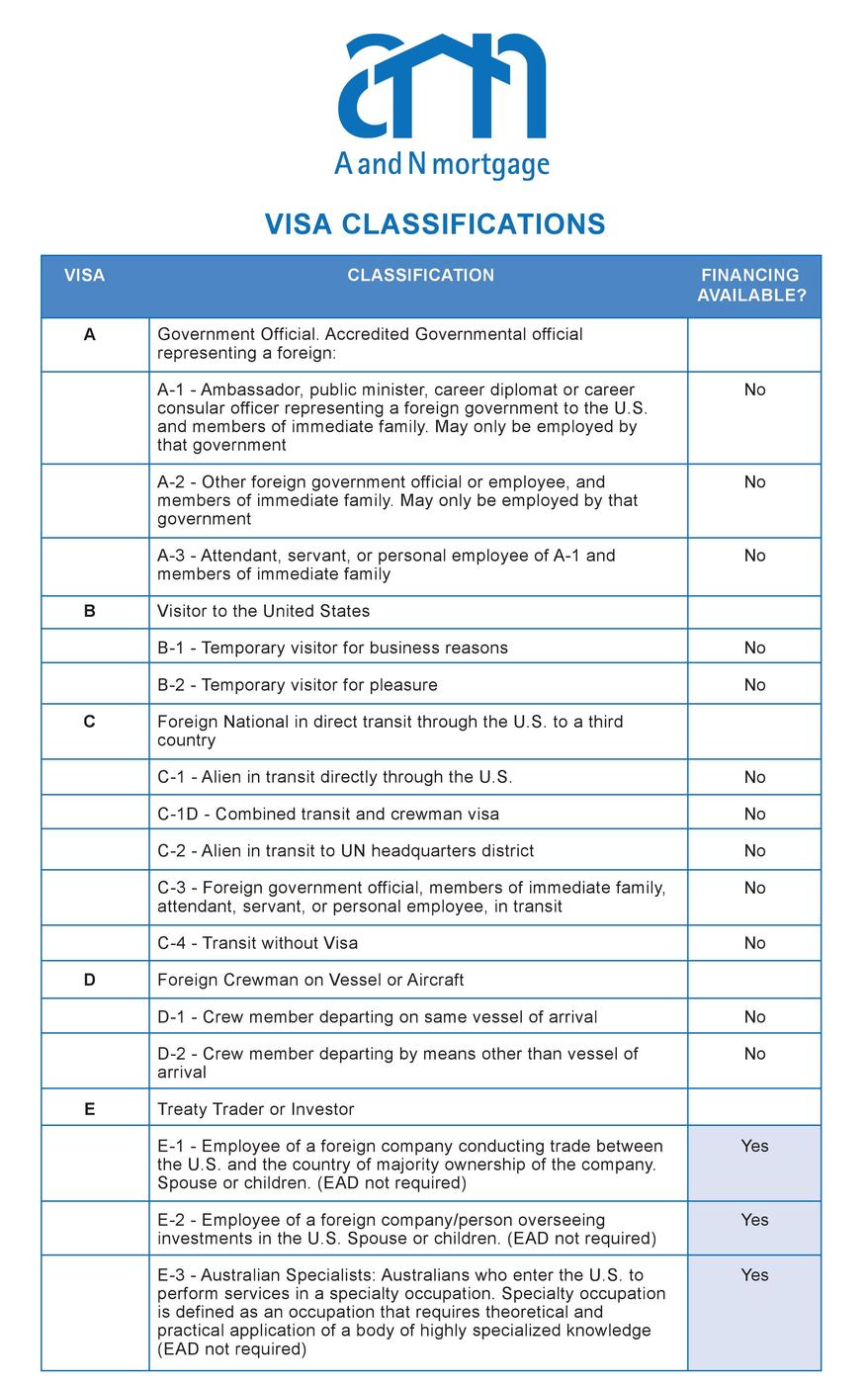

Visa Classifications And Applying For A Mortgage As A Non U S Citizen

94 Mortgage Template Word Page 2 Free To Edit Download Print Cocodoc

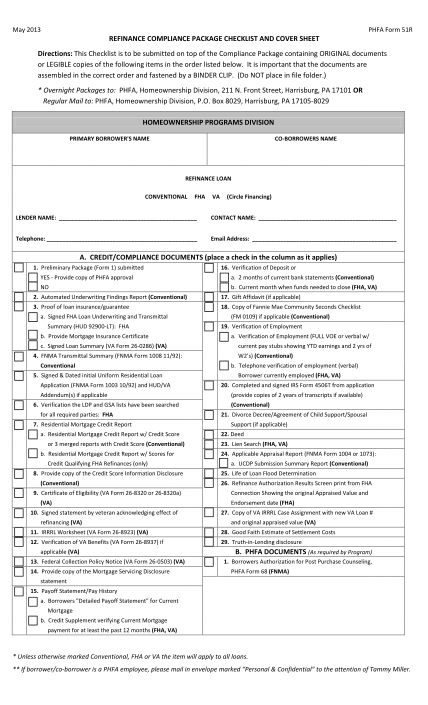

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Triad Guidelines For Kentucky Mortgage Loans Fha Va Khc Usda Fannie Mae Disclosures

How Do Pastors Clergy Or Ministers Qualify For A Usda Loan Usda Loan Pro